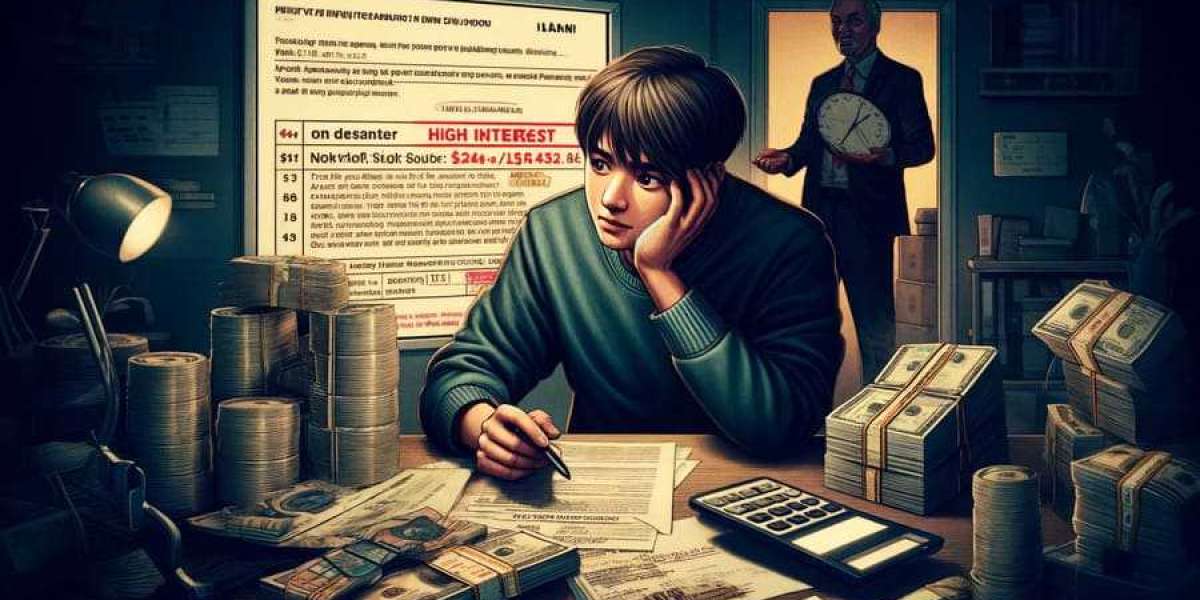

While loans with no upfront charges present many benefits, additionally they come with potential drawbacks.

While loans with no upfront charges present many benefits, additionally they come with potential drawbacks. One significant concern is that lenders might offset the absence of upfront fees with higher rates of interest. Borrowers should carefully analyze the overall value of the mortgage over its complete term as an alternative of focusing solely on preliminary expenses. In some instances, a

Car Loan with upfront fees may actually turn out to be less expensive in the long term if it offers decrease rates of inter

After submitting your utility, you might have to go through some verification steps, similar to offering additional documentation. Once accredited, carefully review the mortgage settlement before accepting any funds to ensure you totally understand all phrases and possible situations connected to the mortg

While it is technically attainable to apply for a number of lease assistance loans, it's not advisable. Applying for a number of loans can impact your credit rating and create a cycle of debt that's hard to handle. It is recommended to evaluate your financial scenario carefully and think about solely applying for a single mortgage that meets your wants. This ensures you could manage repayments successfully and cut back monetary str

The popularity of the lender must also be taken under consideration. Platforms like 베픽 offer reviews and ratings that can help you gauge the reliability of assorted lenders. Customer service quality is one other critical aspect to think about, as you might want assistance during the software or compensation proc

Applying for cash loans when you might have a low credit score score entails a quantity of steps. First, it’s crucial to evaluate your financial wants and determine how much you require. This preliminary stage ensures that you just solely borrow what you can afford to re

Developing a strong repayment strategy not solely helps you stay current in your loan however also can improve your credit score rating over time, making you a extra enticing candidate for future lo

Yes, many lenders specialize in offering loans to these with credit score scores under 600. However, these loans typically include higher interest rates. It's important to evaluate your ability to repay the mortgage on time to avoid

Additional Loan unfavorable impacts on your credit sc

Moreover, the short approval course of means funds may be in a borrower’s account inside hours, equipping them to handle emergencies swiftly. This quick cash infusion can alleviate stress and provide peace of mind throughout important occasi

Alternatives to No Upfront Fee Loans

For those exploring their options, it's worthwhile to consider alternatives to loans with no upfront charges. Traditional loans, while they might contain initial costs, can typically offer lower overall rates of interest and a more predictable repayment structure. Some borrowers may discover that credit score unions or community banks present competitive charges without upfront charges while sustaining a stage of customized serv

Additionally, BePick educates users on managing loans responsibly and encourages monetary literacy, ensuring that borrowers are not simply focusing on instant monetary relief but in addition on long-term financial well being. This holistic strategy positions BePick as an important ally in the borrowing course

Yes, many lenders providing fast cash loans on-line cater to debtors with unfavorable credit score ratings. They usually don't place as a lot emphasis on credit scores compared to traditional banks. However, larger rates of interest may be concerned, reflecting the increased danger to the lender. It's essential to check options to find probably the most favorable phra

In addition to reviews, 베픽 supplies tips about the means to handle loans effectively, guaranteeing that debtors understand their obligations and the significance of well timed reimbursement. It’s an invaluable software for navigating the often-complex panorama of online lo

Before applying, debtors ought to carefully examine the mortgage phrases, together with rates of interest, reimbursement intervals, and additional fees. It's vital to assess your capacity to repay the loan on time to keep away from rollover costs, which might lead to additional debt. Understanding these factors might help you make an informed cho

Loans with out upfront fees have turn out to be more and more well-liked amongst debtors seeking to secure financing without the heavy initial costs typically associated with traditional loans. This monetary possibility provides flexibility and accessibility, making it attractive for so much of people. Understanding how these loans work, their advantages, and potential drawbacks is important for making informed monetary decisions. With varied lenders and monetary establishments now offering such loans, it has also become crucial to navigate the choices carefully to find the most effective phrases and conditions. In this article, we will delve into the specifics of loans with no upfront charges and introduce the internet site 베픽, a resource for complete data and evaluations on this to

슬롯사이트 순위 비교: 최고의 슬롯사이트를 찾아라!

von karinamoreland Revolução no Cuidado Animal: Descubra os Benefícios do Bebedouro Australiano para Gado

von joolucasc1774

Revolução no Cuidado Animal: Descubra os Benefícios do Bebedouro Australiano para Gado

von joolucasc1774 L.M. Ching: Establishing New Benchmarks in Customer-Oriented High-End Skincare Distribution

von randalllowranc

L.M. Ching: Establishing New Benchmarks in Customer-Oriented High-End Skincare Distribution

von randalllowranc Innovation Amid Raids: Inside Nigeria's Dynamic Sports Betting Industry

von willardweather

Innovation Amid Raids: Inside Nigeria's Dynamic Sports Betting Industry

von willardweatherHow to Play UFACash Poker Like a Pro

von ezequielq86956