In conclusion, online loans for medical expenses provide an important lifeline for a lot of dealing with surprising healthcare costs.

In conclusion, online loans for medical expenses provide an important lifeline for a lot of dealing with surprising healthcare costs. Through strategic consideration and knowledgeable decision-making, people can secure the monetary help they want, ensuring well timed access to needed medical care. Whether by way of private loans, medical bank cards, or peer-to-peer platforms, understanding the choices available is important for efficient financial administration in times of medical w

Furthermore, the repayment terms are typically brief, usually requiring

Monthly Payment Loan within two to 4 weeks. This tight timeline can place extra stress on debtors, particularly if their monetary state of affairs does not enhance in that timeframe. Therefore, it's essential to assess your monetary capabilities earlier than committing to such lo

Personal loans may be either secured or unsecured, with secured loans requiring collateral. Understanding the differences among these mortgage sorts can help debtors choose the one that aligns with their monetary situation and reimbursement capability. Additionally, borrowers should consider their long-term financial goals when selecting a mortgage s

Looking for Reliable Information? Explore Bepick

Bepick is a valuable online resource that makes a speciality of providing detailed information about online loans for medical bills. This platform presents complete evaluations, comparisons of various lenders, and tips about navigating the healthy financing panorama. For anybody exploring financial options for medical bills, Bepick serves as a trusted gu

Furthermore, online loans provide versatile compensation options. Lending platforms permit borrowers to choose phrases that swimsuit their financial situations, which could be especially important for managing ongoing medical therapy. By assessing varied online mortgage products, individuals can identify loans that provide competitive rates of interest and favorable circumstan

BePick emphasizes transparency in lending practices and goals to make clear the often-overlooked aspects of cash loans for low credit score. By visiting BePick, users can access a wealth of sources that guide them through the mortgage utility process, offering tips on how to enhance their chance of approval and safe the best rates out th

Choosing the Right Lender

With numerous choices available, deciding on the best lender for high approval payday loans is a important step. It is essential to research various lenders and skim reviews. Websites like BePick can provide priceless information, evaluating different lenders' charges, customer support rankings, and application proces

Moreover, the net nature of these loans allows borrowers to match different lenders easily. This competition can result in better rates of interest and phrases. Borrowers can learn reviews and testimonials, gaining insights from different prospects to make informed decisions about which lender to cho

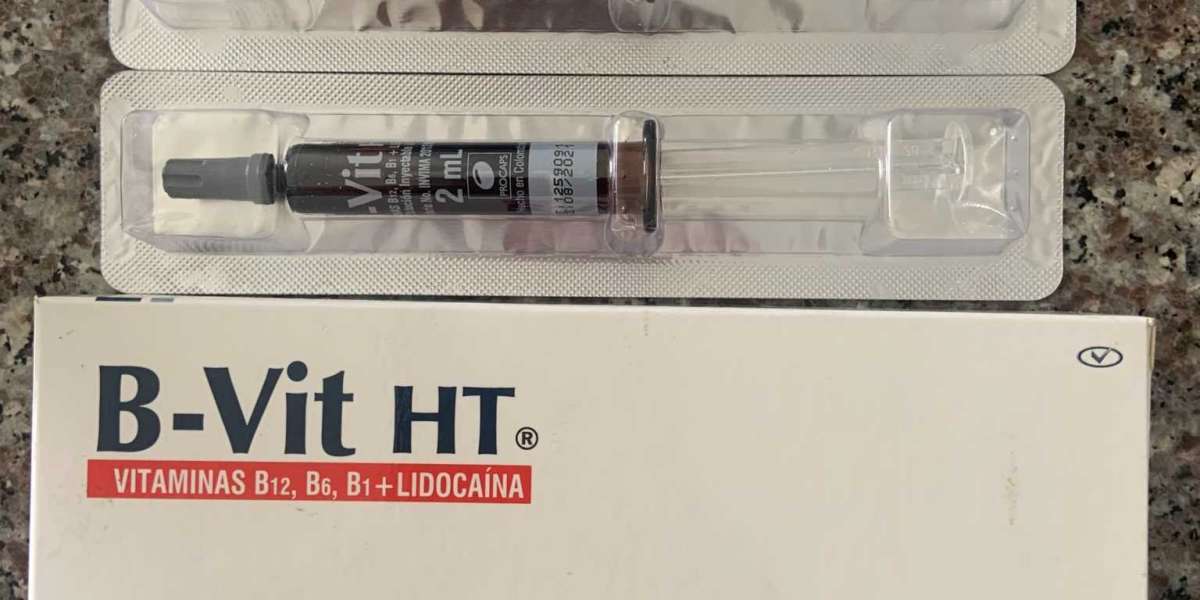

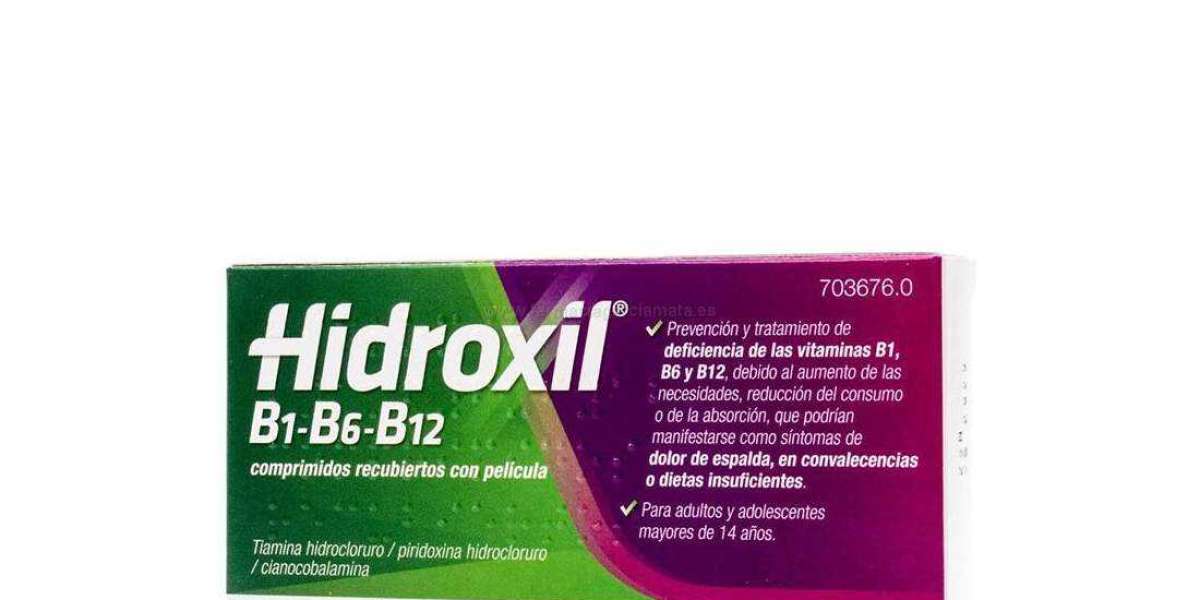

These loans can be utilized to cover a extensive range of medical costs, together with hospital payments, surgeries, treatment, and even alternative therapies. Nonetheless, it is important to understand the terms and conditions associated with these loans, as rates of interest and compensation schedules can differ considera

Improving your possibilities of

이지론 cash mortgage approval entails demonstrating stable earnings and a accountable borrowing historical past. Providing lenders with proof of employment and income can bolster your utility. Additionally, contemplate making use of for smaller mortgage amounts, as they might be less dangerous for lenders, increasing your probability of receiving approval regardless of a low credit sc

Advantages of High Approval Payday Loans

One of the main benefits of high approval payday loans is the short access to funds. This fast turnaround can be lifesaving when dealing with surprising bills. For those that may not qualify for conventional financial institution loans as a outcome of credit score issues, these payday loans present a possible various. Borrowers respect the convenience of making use of on-line, often from the consolation of their hou

n Common assets embrace real estate properties, cars, savings accounts, and even useful collectibles. However, the precise types of collateral accepted can vary by lender, so it’s important to check with your chosen monetary establishment for his or her insurance polic

By utilizing platforms like 베픽, potential borrowers could make more informed choices, avoiding predatory lending practices and making certain they select a lender that aligns with their financial wants and compensation capabilit

Moreover, the fast entry to cash can lead to impulsive spending. Borrowers ought to only apply for what they genuinely want for medical bills quite than extra funds that may lead to monetary strain la

Variety: Online lenders usually supply a extensive range of mortgage types and phrases. Borrowers can choose the choice that best suits their wants, whether they prefer a short-term

Small Amount Loan or a longer repayment sched

슬롯사이트 순위 비교: 최고의 슬롯사이트를 찾아라!

von karinamoreland Innovation Amid Raids: Inside Nigeria's Dynamic Sports Betting Industry

von willardweather

Innovation Amid Raids: Inside Nigeria's Dynamic Sports Betting Industry

von willardweather Revolução no Cuidado Animal: Descubra os Benefícios do Bebedouro Australiano para Gado

von joolucasc1774

Revolução no Cuidado Animal: Descubra os Benefícios do Bebedouro Australiano para Gado

von joolucasc1774 L.M. Ching: Establishing New Benchmarks in Customer-Oriented High-End Skincare Distribution

von randalllowranc

L.M. Ching: Establishing New Benchmarks in Customer-Oriented High-End Skincare Distribution

von randalllowranc Disappear it's flat test

von 1980kozera

Disappear it's flat test

von 1980kozera