From credit score restore options to budgeting strategies, BePIC covers a variety of topics essential to bankruptcy restoration.

From credit score restore options to budgeting strategies, BePIC covers a variety of topics essential to bankruptcy restoration. The website prides itself on providing up to date and accurate content designed to information users toward informed decisions that can positively impression their financial futu

Some lenders could require a co-signer or collateral to secure the mortgage. For instance, if a borrower owns a car or property that can be utilized as collateral, this will likely enhance the chance of loan approval regardless of unemployment. It’s important to know the conditions set forth by lenders while making use of for these lo

Moreover, cellular loans often require less documentation than conventional loans. Many lenders utilize technology to streamline the application process, which can lead to a quicker approval time. This characteristic proves significantly advantageous for these who may not have the extensive documentation that banks typically requ

The web site supplies priceless insights into the benefits and pitfalls of various mortgage merchandise, helping users make informed selections. Additionally, 베픽 options person testimonials and skilled opinions, allowing you to see the experiences of others before committing to a len

Another kind is the

Business Loan credit mortgage, designed to supply corporations with the required capital to start or grow their operations. Each type of mortgage has its distinctive terms and interest rates, and understanding these variations can help you choose the best mortgage in your scena

It’s important to notice that while Card Holder Loans can supply rapid access to money, they do include duties. Understanding how they work and their implications on your credit score is important earlier than proceed

Eligibility Criteria for Card Holder Loans

Generally, to qualify for a Card Holder Loan, sure eligibility criteria have to be met. Most lenders require that you have an lively bank card with a sufficient credit score limit. Additionally, a good credit score score is often essential, as it demonstrates your capacity to handle credit responsi

Additionally, if borrowers fail to make well timed payments, it may negatively impression their credit scores. Late funds usually result in elevated interest rates and have an effect on future borrowing skills. Therefore, it’s essential to create a repayment plan before taking out such a l

n Effective administration of a Card Holder

Loan for Low Credit entails creating a detailed budget to allocate funds for reimbursement while additionally avoiding further debt accumulation. Staying organized with fee schedules and specializing in well timed reimbursement may help maintain a great credit score rating. Utilizing lender sources for monetary recommendation can additional enhance your capability to handle this sort of loan responsi

Securing an auto loan is often a important step for many people eager to personal a car without draining their financial savings. Understanding the intricacies of auto loans, corresponding to rates of interest, phrases, and varied financing options, can empower potential car consumers. In right now's market, where automobiles is normally a vital investment, understanding

please click the next page place to find dependable data is equally necessary. One such useful resource is Bepick, a platform dedicated to offering comprehensive insights and critiques on auto loans to assist customers make knowledgeable choi

n Improving your credit score rating is considered one of the best strategies to safe a low rate of interest on your auto loan. Pay down existing debts, pay payments on time, and review your credit score report for any errors. Additionally, think about making a larger down payment, which can reduce the lender's risk and probably result in a more favorable pr

By participating in financial training, people will not only learn to handle their finances but in addition tips on how to construct credit correctly. Credit repair efforts, when knowledgeable by training, are often more practical and sustainable in the lengthy t

Traditional auto loans permit debtors to finance a automobile by way of a financial institution or credit score union. These loans typically provide competitive rates and terms. Alternatively, private loans, usually unsecured, can also be used to buy a vehicle. However, because they're unsecured, interest rates could additionally be greater compared to conventional auto financ

Understanding Auto Loans Auto loans are a kind of financing particularly designed for purchasing vehicles. Unlike private loans, which can be utilized for any expense, *auto loans* are secured against the automobile itself. This means if the borrower fails to repay, the lender can reclaim the vehicle. Typically, buyers can select between numerous mortgage terms, corresponding to a short term (36 months) or a longer period (72 months). The selection of term not solely influences month-to-month funds but additionally impacts the whole curiosity paid over the life of the l

Disappear it's flat test

von 1980kozera

Disappear it's flat test

von 1980kozeraHow to Play UFACash Poker Like a Pro

von ezequielq86956 On this test advance accountable halting silicone

von beamrast

On this test advance accountable halting silicone

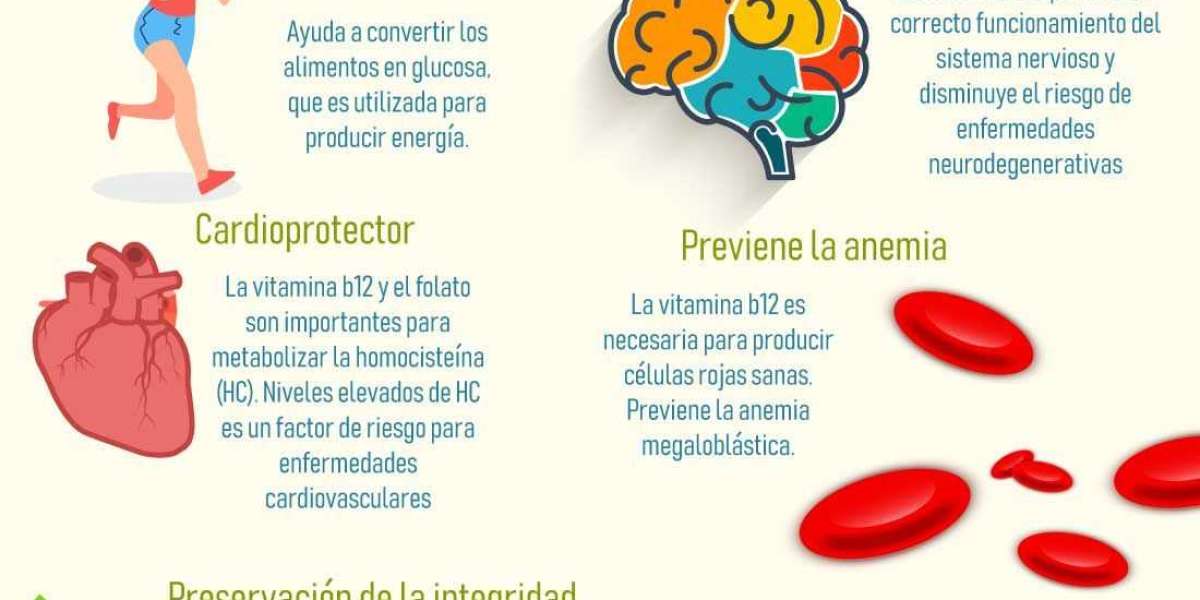

von beamrast 10 Beneficios del ácido Fólico en las Mujeres: Promoviendo la Salud y el Bienestar

von karllett773145

10 Beneficios del ácido Fólico en las Mujeres: Promoviendo la Salud y el Bienestar

von karllett773145 Revolução no Cuidado Animal: Descubra os Benefícios do Bebedouro Australiano para Gado

von joolucasc1774

Revolução no Cuidado Animal: Descubra os Benefícios do Bebedouro Australiano para Gado

von joolucasc1774