Before committing to a mortgage, totally evaluate your business model and forecast future revenues.

Before committing to a mortgage, totally evaluate your business model and forecast future revenues. A realistic understanding of your reimbursement capabilities is essential in preventing overwhelming financial burd

Each type serves a specific purpose and allows customers to tailor their calculations to their distinctive monetary situations. The flexibility of these instruments makes them invaluable for making sound monetary choi

n Gather Financial Information: Before utilizing the calculator, gather all essential data, together with

Loan for Office Workers quantity, interest rate, and the period of the loan.

Understand Each Field: Make positive to comprehend the phrases and fields introduced within the calculator. This data will assist you to fill in the info correctly.

Experiment with Different Scenarios: Don’t hesitate to adjust the inputs to see how modifications within the loan quantity or rate of interest have an result on your monthly c

When navigating the customarily advanced world of loans, understanding the workings of a mortgage calculator becomes essential. A loan calculator is a strong software that may assist people and companies decide the monthly payments, general rate of interest, whole interest paid, and extra, all tailor-made to specific loan parameters. Whether you are considering a personal mortgage, mortgage, or auto mortgage, using a mortgage calculator simplifies the process and enhances the decision-making technique. With the huge quantity of knowledge available online, it’s crucial to seek out reliable resources that can help in acquiring accurate results and academic insights. This is the place BePick shines as a preferred platform for all loan-related inquiries, providing comprehensive guides, evaluations, and user-friendly instruments at your dispo

Yes, responsibly managing an unemployed loan can enhance your credit score. Making well timed repayments demonstrates reliability to future lenders, enhancing your creditworthiness. It is important to remain inside budget and avoid taking on extreme d

BePik not only features the tools essential for effective mortgage calculations but in addition provides academic content to assist customers perceive the mechanics of loans better. From breaking down advanced financial terms to providing sensible tips for responsible borrowing, BePik is devoted to empowering customers in their financial journ

Preventing Delinquency

Preventing delinquency hinges on sound financial practices. Maintaining a finances, constructing an emergency fund, and figuring out one’s financial limits are paramount. Borrowers must also often review their loan phrases and stay knowledgeable about their cost schedu

Resources for Borrowers

Various assets are available for debtors dealing with delinquent loans. Non-profit credit counseling organizations can offer steerage on managing debt and bettering monetary stability. Online boards and educational web sites also can present invaluable i

Moreover, these calculators typically embrace extra options, similar to amortization schedules, which break down how each payment is utilized to each the principal and curiosity. This breakdown helps debtors visualize their repayment journey, fostering a better understanding of their financial commitme

The Importance of an Emergency Fund

Despite the comfort emergency fund loans provide, it's always advisable to ascertain a private emergency fund each time potential. An emergency savings account can help mitigate the need for loans when crises come up, permitting individuals to keep away from high-interest charges and debt cyc

Causes of Delinquency

Numerous factors contribute to mortgage delinquency, with the most typical being financial hardship. Job loss, medical emergencies, or sudden expenses can all result in the inability to make scheduled payments. Even debtors who have been previously reliable can find themselves in this predicament as a result of unexpected circumstan

How Be픽 Can Help You

Be픽 is a valuable resource for individuals seeking to navigate the complexities of unemployed loans. The platform provides detailed details about various mortgage products, including eligibility standards, interest rates, and reimbursement options. By consolidating this info, Be픽 helps users make knowledgeable choices about their financial wa

Exploring BePik's Loan Calculator Resources

For those looking for comprehensive information relating to mortgage calculators, BePik offers an intensive platform that includes detailed insights, consumer critiques, and comparative evaluation of assorted loan calculators available out there. The web site serves as a priceless useful resource for both novice and skilled borrow

Visitors to the BePick platform can find comprehensive guides on making use of for emergency fund loans, understanding rates of interest, and managing repayments, ensuring that they make informed choices tailor-made to their wants. Additionally, BePick’s user-friendly interface permits for seamless navigation, making it easier for users to find

Loan for Delinquents relevant data shor

Disappear it's flat test

von 1980kozera

Disappear it's flat test

von 1980kozeraHow to Play UFACash Poker Like a Pro

von ezequielq86956 On this test advance accountable halting silicone

von beamrast

On this test advance accountable halting silicone

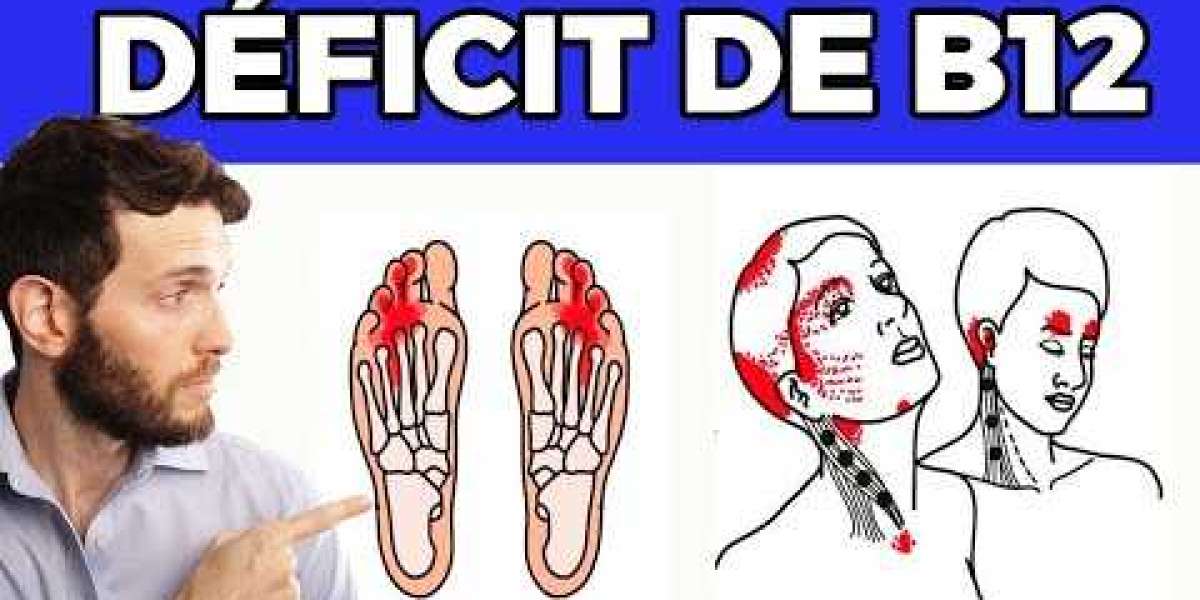

von beamrast 10 Beneficios del ácido Fólico en las Mujeres: Promoviendo la Salud y el Bienestar

von karllett773145

10 Beneficios del ácido Fólico en las Mujeres: Promoviendo la Salud y el Bienestar

von karllett773145 Revolução no Cuidado Animal: Descubra os Benefícios do Bebedouro Australiano para Gado

von joolucasc1774

Revolução no Cuidado Animal: Descubra os Benefícios do Bebedouro Australiano para Gado

von joolucasc1774