After submitting the formal application, lenders will assess the borrower's creditworthiness and property worth via an appraisal.

After submitting the formal application, lenders will assess the borrower's creditworthiness and property worth via an appraisal. This step is pivotal, because it determines whether the mortgage will be approved. If accredited, the lender will problem a mortgage estimate outlining the phrases, charges, and fees, offering a clear image of what to exp

When considering financing options, evaluating pawnshop loans with traditional loans is significant. Traditional loans typically have decrease rates of interest and longer compensation phrases, however they also come with stricter approval processes and credit checks. This might make them inaccessible for some peo

If you're unable to repay your pawnshop loan by the due date, the pawnshop will retain and promote your item to recuperate the loan quantity. It's essential to contemplate your capability to repay earlier than taking out a loan, significantly if the merchandise has vital emotional va

Additionally, speeding via the process or skipping pre-approval can lead to missed opportunities or unfavorable terms. It’s additionally important to keep away from making significant financial changes before or during the application course of, as these actions can jeopardize appro

Pawnshop loans offer a singular financing option for people needing quick cash with out the burdensome necessities of traditional bank loans. Understanding how pawnshop loans work, their advantages, and potential drawbacks is essential for anybody contemplating this financial resolution. This article will explore the intricacies of pawnshop loans, while also introducing Be픽, a priceless useful resource for info and reviews about this financing met

Common Pitfalls to Avoid

Many borrowers fall into widespread traps when securing an auto mortgage. One main pitfall is focusing solely on the monthly payment without contemplating the general price of the mortgage. A decrease monthly payment often means a longer

Loan for Unemployed time period, which can lead to greater curiosity priUtilizing the resources available on Betpick not only prepares users for the mortgage utility course of but also contributes to a more knowledgeable and successful house buying or refinancing expert

Disadvantages to Consider

Despite their advantages, emergency loans also have notable downsides. One important concern is the high-interest rates that accompany many emergency loan options. Borrowers could discover themselves in a tough situation if they fail to repay on t

Card Holder Loans sometimes allow you to borrow against the out there credit score on your bank card, providing quick access to money. In contrast, private loans involve a formal software course of, typically requiring a credit score check and securing a fixed amount with a set reimbursement time period. Interest charges on private loans may be decrease, making them a less expensive choice for some debt

BePick: Your Go-To Resource for Card Holder Loans

For anybody considering a Card Holder Loan, BePick serves as an invaluable useful resource. The website provides a complete overview of financing options, skilled critiques, and comparisons tailored for Card Holder Loans. Whether you're looking for the most effective rates, understanding the application course of, or just gathering extra data, BePick supplies a user-friendly platform that facilitates knowledgeable decision-mak

Next, they'll analysis different lenders to find out which establishments provide the most favorable terms. Many lenders enable online applications, making it simple to apply and receive approval quic

Credit-deficient loans are a rising concern in today's monetary landscape. Individuals facing credit score issues could find obtaining conventional loans difficult. Such loans often include higher rates of interest and stringent repayment terms, making financial planning tough. However, alternate options do exist, and understanding these loans can empower shoppers to make informed monetary choices. This article explores the concept of credit-deficient loans, the implications for debtors, and assets like BePick that can present valuable info and evaluations on such monetary opti

n Improving your credit score by paying payments on time, decreasing debt, and avoiding new credit score accounts can improve your probabilities of securing a real estate mortgage. Additionally, gathering all needed monetary paperwork and providing them to potential lenders can streamline the applying process, making it simpler for them to evaluate your ski

For those looking to educate themselves about pawnshop loans, Be픽 presents an impressive platform. This website presents detailed information, reviews, and insights into numerous pawnshop loan establishments, helping individuals make informed choices. Visitors can access useful articles that break down processes, spotlight tendencies, and offer tips for

이지론 maximizing pawnshop lo

Disappear it's flat test

von 1980kozera

Disappear it's flat test

von 1980kozeraHow to Play UFACash Poker Like a Pro

von ezequielq86956 On this test advance accountable halting silicone

von beamrast

On this test advance accountable halting silicone

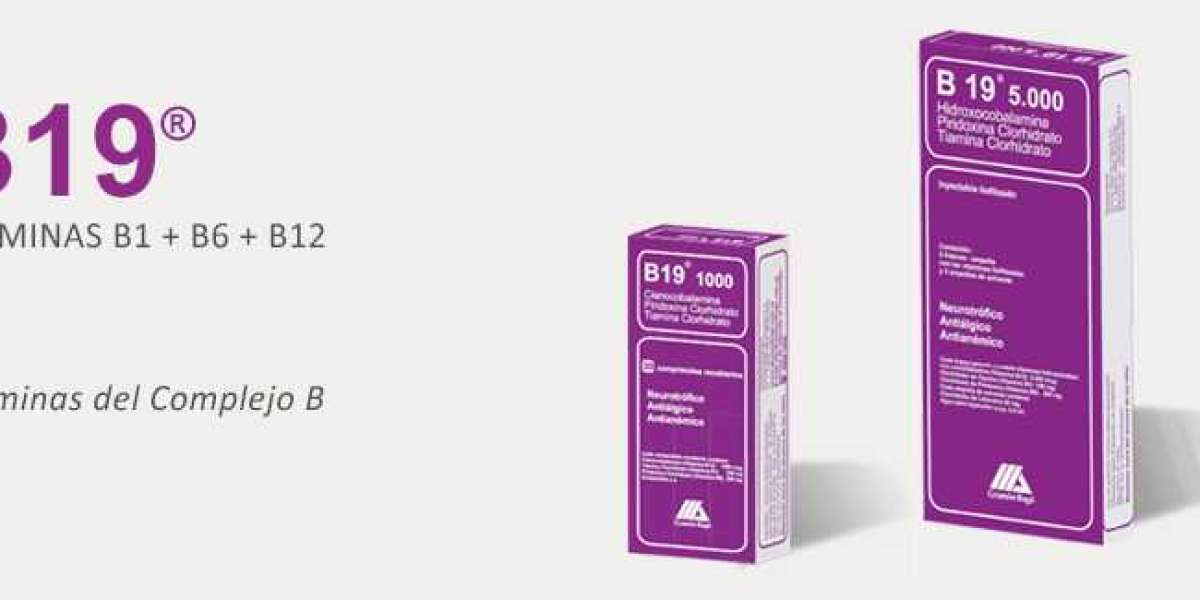

von beamrast 10 Beneficios del ácido Fólico en las Mujeres: Promoviendo la Salud y el Bienestar

von karllett773145

10 Beneficios del ácido Fólico en las Mujeres: Promoviendo la Salud y el Bienestar

von karllett773145 Revolução no Cuidado Animal: Descubra os Benefícios do Bebedouro Australiano para Gado

von joolucasc1774

Revolução no Cuidado Animal: Descubra os Benefícios do Bebedouro Australiano para Gado

von joolucasc1774